These days, we are reminded constantly of how swiftly things can change. The COVID-19 pandemic in particular demonstrated just how easily life as we know could be upended.

When crises hit—whether it’s an individual emergency or a global event—organizations like yours are in the unique position to lend a hand.

Setting up an emergency relief fund ensures that you’re ready to support your community in times of crisis. With an emphasis on speed and flexibility, a relief fund allows your organization to provide rapid, tax-free assistance to the folks who need it most. You can also use your fund to tap into and pool additional resources from the broader community.

What is a relief fund?

A relief fund is a pool of money designated to help people in crisis. It can help folks through a personal emergency, such as a car accident, illness, or house fire. Or it can address a local or global event, such as a natural disaster or a pandemic. The fund is used to make grants, which are awarded directly to people in need or to organizations doing relief work.

For businesses looking to launch a relief fund, there are two distinct approaches: you can create an employee or a community relief fund.

- An employee relief fund is designated to help your employees through a personal crisis.

- A community relief fund allows you to support a specific community affected by an event.

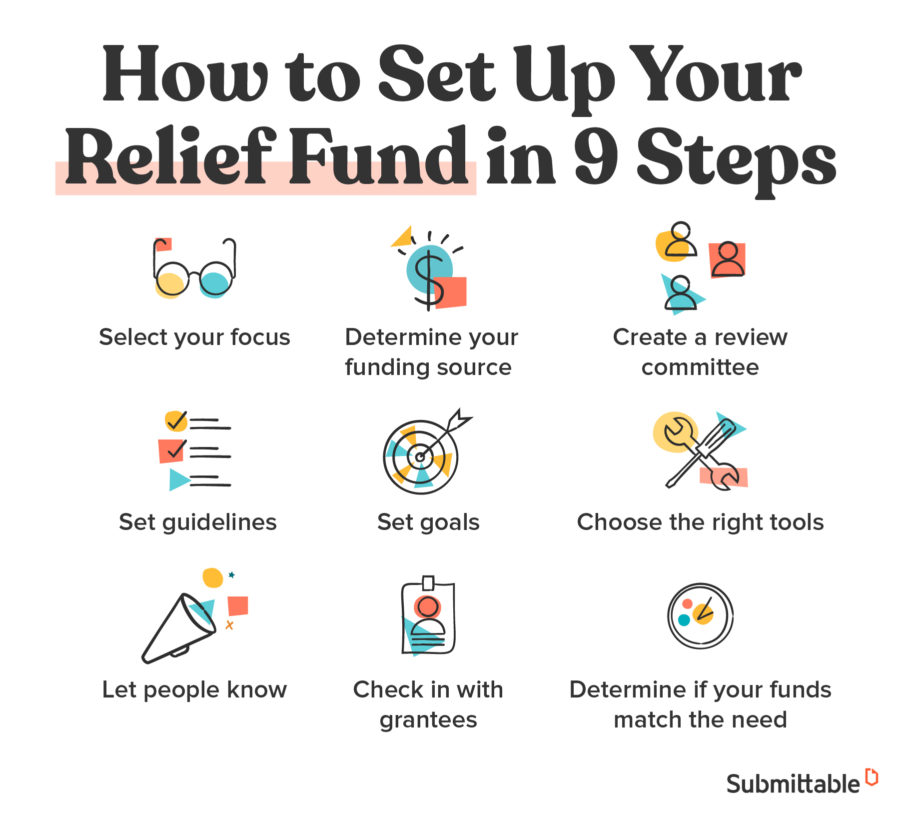

Regardless of the approach you take, the following nine steps can help you strategize, launch, and manage a successful relief fund.

How to set up your relief fund in 9 steps

1. Select your focus

To determine how to structure your fund, decide whether you want to offer relief to employees or the community.

Employee relief fund

First, consider the benefits of an employee relief fund. In 2020, 36% of U.S. households said they would not be able to cover an unexpected $400 expense. For these folks, a sudden accident can create an incredible amount of financial and emotional stress.

Having resources at the ready to help your employees benefits everyone. You can relieve the financial stress and allow them to focus instead on the emotional, physical, and logistical components of recovery. Stressed-out people don’t do good work. Helping ease their burden allows them to bring their best selves to the team.

Plus, creating an employee relief fund can also help foster a positive work culture and decrease turnover. Your employees are not just the hours they put in—they have full, complex lives. If you treat them with empathy and compassion, they are much more likely to stick around.

Community relief fund

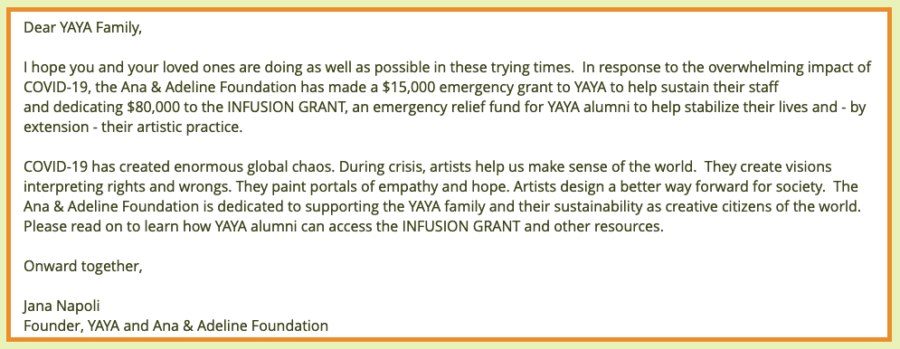

If you already have an employee relief fund or are interested in reaching out in a different way, a community relief fund is a good option. Consider who you are looking to help. Are you launching a fund in response to an event or disaster, or are you targeting a specific group such as kids, educators, LGBTQ folks, survivors of domestic violence, etc.? For example, the nonprofit Artist Trust used a relief fund to support Washington artists affected by the COVD-19 pandemic.

Be sure to identify what the community you are targeting needs. Will direct cash payments help? Or would it be more important to provide things like food, shelter, and supplies? Often in the immediate aftermath of a disaster, this more tangible aid is essential. In that case, look for nonprofits doing aid work on the ground.

2. Determine your funding source

Of course, you’ll need some seed money to launch your relief fund. Beyond that, you’ll need to identify other ways to boost the budget. Enlisting donors is a great way to extend your ability to help. You can do this through:

- Employee donations: Allow employees to use paycheck deduction so they can donate to the fund tax-free. To provide an extra incentive, you can also offer to match these donations.

- Fundraising: With a fund in place, you can reach out to your community for support by creating fundraising events or campaigns.

- Partnerships with other organizations: Find other businesses or foundations that may be interested in supporting your cause and see if they want to pool resources.

3. Create a review committee

Before you start a fund, you need to decide which of your teams will manage the project. Some companies use human resources, others rely on their CSR team. Beyond that, you need to set up a committee to review applications.

For a community relief fund, your review committee should represent a broad cross section of your organization. These folks are not acting on behalf of the company; they will be acting as individuals. So you want to cultivate a group with a variety of diverse perspectives. For example, don’t create a committee of only leadership or only HR. If possible, you’ll also want to include voices from the communities being served since they know best what their community members need.

For an employee relief fund, prioritize anonymity. You want to ensure employees feel comfortable asking for assistance. To do so, you might consider forming a committee with folks from outside your organization.

4. Set guidelines

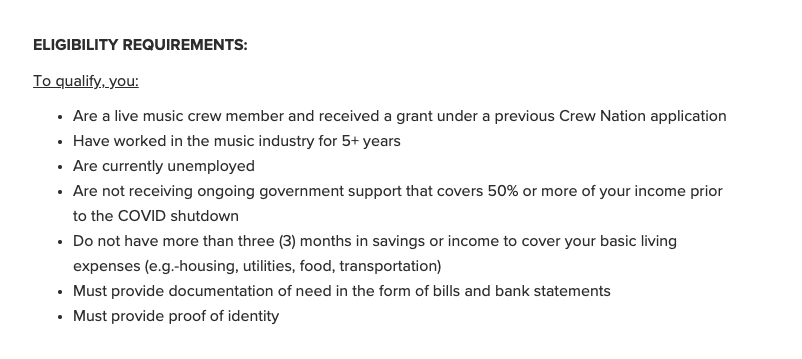

Once you have your committee assembled, you need to create guidelines for applicants. First and foremost, you need to decide who can apply. If you’re focused on employee relief, you need to determine what kind of qualifying events you will cover. For a community relief fund, you need to decide whether you’re providing aid to individuals or organizations. Also determine any other parameters around qualifying for assistance. Do grantees need to live in a certain area or be part of a particular demographic?

You’ll also need to decide how grantees can spend the money they receive. Although you might have specific uses in mind, be mindful of creating too many restrictions. In the face of disaster, people need flexibility. Trust the people you’re helping to know what’s best for them—just make sure you’re adhering to IRS guidelines.

Be clear about your guidelines. State plainly what qualifications applicants must meet and what documentation they need to provide. And include up front the minimum and maximum grant amounts so people know what to ask for and expect.

5. Set goals

You’re creating a relief fund to provide assistance to those in need. The last thing you want is for the money you raise to go unused. Setting goals can be a good way to hold yourself accountable.

Don’t worry about getting too specific or granular with your goals. You can aim for a certain amount of money awarded or number of grantees. You can also set intentions around fundraising and employee participation. Putting a few goals in writing ensures that you have a way to compare the results of the program to what you originally envisioned. It can also help you make your case to potential donors.

6. Choose the right tools

When you look for software to help you manage your relief fund, you want to focus on ease and equity. Look for a solution that helps you:

Create a simple, easy process for grantees

The last thing you want to do is make things complicated. Choose a solution that houses everything in one platform and is easy to navigate.

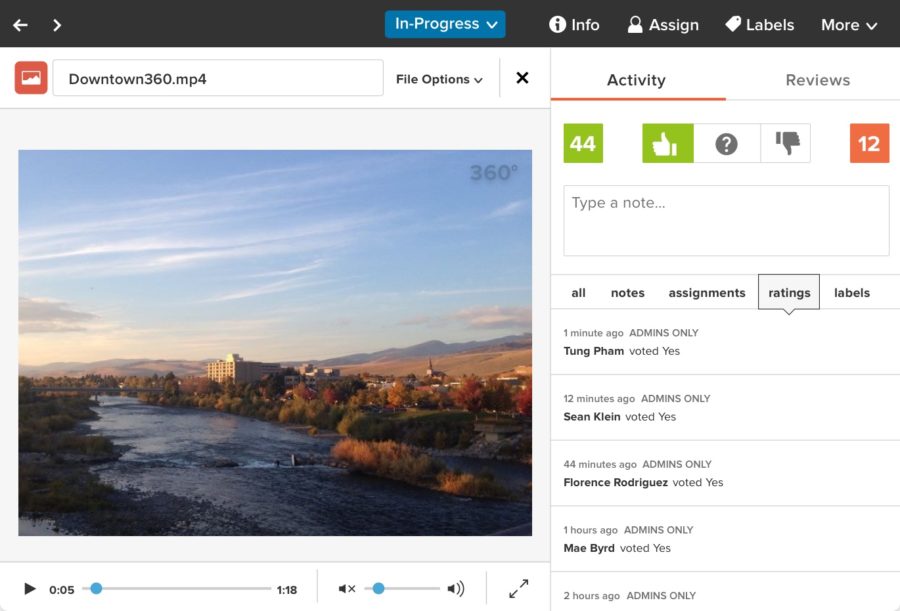

Streamline the review process

Make it easy on your review team by choosing a solution that allows them to view all the application materials without having to download them.

Deliver funds quickly

To provide relief in a crisis, you want to get money to grantees as fast as possible. Look for software that can support digital funds distribution.

Make equity a priority

Find a solution that allows you to conceal responses from the review team so you can hide personal or demographic data. And be sure your application is accessible via a mobile device.

Measure your impact

The right software will allow you to collect quantitative and qualitative data to understand how your program is making a difference for grantees.

Expand programs in the future

A robust platform will allow you to launch new CSR programs with ease.

Find the best tool to manage your relief fund.

Check out our brand new grants management software buyers’ guide.

7. Let people know

Once you have your fund up and running, you need to get vocal and find ways to spread the word. For an employee relief fund, be sure to reach out to employees in multiple ways. Don’t just bury the announcement in an email. Highlight it in company meetings and on social media, put up posters around the office, or ask managers to explain the fund directly to their teams.

When people need help, you want them to have the relief fund information on hand. So create clear instructions about how to access the application and who will be the point of contact for questions.

For community relief funds, find ways to reach out to potential grantees. Get in touch with organizations working with the population you want to help. Be proactive; look for people or groups who fit the bill and invite them to apply. Use social media to spread the word.

If you’re hoping to get employee donations to help support the relief fund, include them in the process as much as possible. Share your inspiration for launching the relief fund and any company goals you have around it. Do your best to inspire folks to get involved.

8. Check in with grantees

With the right teams and tools in place, you’re all set up to start accepting applications and delivering funds. You’ll also want to make it part of your process to get feedback from the grantees. Remember, you’re helping folks who are dealing with crises, so don’t expect them to complete long questionnaires.

For example, when Brooklyn Community Foundation mobilized a response fund for area nonprofits in March 2020, they did their best to minimize burdens for the nonprofits.

Even before our COVID-19 response, we've been working to minimize the burden on nonprofits because we understand that even the process of applying and responding to RFPs, that's labor.--Marcella J. Tillett, Vice President of Programs and Partnerships at Brooklyn Community Foundation

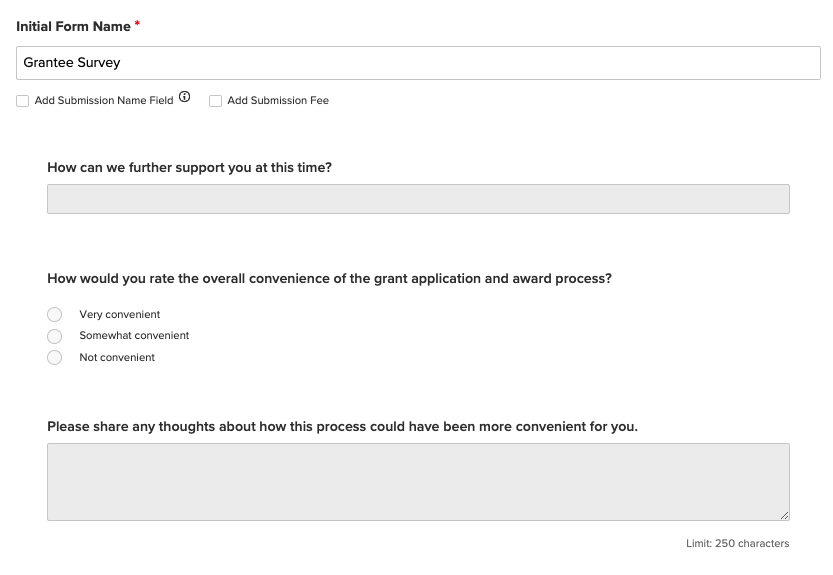

Narrow down what you want to know about your grantees’ experiences and find an easy way for them to get in touch. A short survey is a great tool for this.

Don’t forget to center your grantees and their humanity. Use language that acknowledges their hardship and give them space to share their stories if they want. Ask short, but open-ended questions. Arts Mid-Hudson, a nonprofit dedicated to supporting artists in the Hudson Valley, found that asking open-ended questions helped them identify what kind of data was really important.

Your grantees can offer you a unique view of your relief program. Don’t squander it. If they take time to share feedback, be sure to look for ways to address any of their concerns. If you’re hearing from grantees that some part of the application process is unnecessarily challenging or confusing, look for ways to make things simpler.

Be ready for the future.

Submittable can help you set up a relief fund so you’re prepared to help when a crisis hits.

9. Determine if your funds match the need

As you assess the success of your program, you’ll want to determine whether your funds match the needs of the people you want to serve. If you find yourself turning qualified applicants away, you might look for ways to raise more money. Or you could narrow your focus to a smaller demographic. For example, if you’re providing aid for folks after a disaster, perhaps next time you’ll focus on folks with low income or families with children.

If instead you are not receiving enough applications for the funds you have available, you might consider expanding the requirements. You can also look at your outreach. Can you get in touch with organizations and people who would qualify and make it easier for them to apply? As Crew Nation found out when they rolled out a relief program for touring and venue crew members affected by the pandemic, flexibility and adaptability were key.

Be ready to meet the moment

When the pandemic hit, philanthropy—like everything—went through an incredible upheaval. The organizations that had done the work of setting up a relief fund were ready to meet the moment. As Kristin Kenney of Carol Cone ON PURPOSE observes regarding 2020, “Companies that had a program and purpose in place were able to respond much more quickly and authentically.” Taking time to put the processes, infrastructure, and tools in place now will ensure that you are prepared to provide rapid relief when your community needs it most.

Submittable is a corporate giving software built to help you launch and manage your relief fund. As a social impact platform focused on equity and simplicity, we can help you make a meaningful impact right away. Get in touch to find out how.