Grantmakers, particularly in the public sector, face quite a challenge. They are tasked with getting funds—often emergency or desperately needed relief funds—into the hands of the deserving as quickly as possible.

However, government and enterprise-level funders are also particularly vulnerable to bad actors. This can be attributed in part to the vast amount of money available, tempting fraudsters who smell an opportunity. It’s also in part a result of the imperative to quickly disburse relief to folks who are hurting—without sufficient tools, identity verification takes time that funders typically don’t have.

Fraud associated with federal COVID relief is estimated at $250 billion. That’s billion, with a B. It’s unfortunate—especially considering those dollars could have helped so many people who are struggling right now. The fallout in the wake of the deception, in terms of the hit to reputation, confidence in process, and other consequences, is considerable as well.

The good news is that it’s not inevitable. Identity fraud in grant programs can be mitigated.

In step with our commitment to innovate, Submittable is thrilled to announce the release of our new Fraud Prevention feature, which includes two specific tools: Knowledge Based Authentication and Identity Verification.

Watch the video above or read on to learn more about how these tools can drastically reduce fraud among grant applicants, while requiring virtually zero lift from your team.

What is Knowledge Based Authentication?

Submittable’s first Fraud Prevention tool is called Knowledge Based Authentication.

Knowledge-Based Authentication, or KBA, is a tool that financial services and other industries have used for years to verify the identity of individuals at certain transaction points, such as when they apply for a new credit card.

A KBA consists of a series of questions about someone’s private and personal history. Some KBA quizzes are static, meaning that the individual supplies the answer themselves in advance. A static KBA is a common step in password retrieval for many online systems.

Submittable uses a dynamic KBA quiz.

A dynamic KBA quiz is a higher level of security that has an additional benefit of bypassing the need for the individual to supply answers in advance. Thus, it can be deployed to your applicant pool.

A dynamic KBA generates questions based on public and private data sources, such as marketing data, credit reports, or transaction histories. The questions are designed so that only the individual would readily know the answer.

For instance, typical KBA questions include:

- With which of these addresses are you associated?

- Which of these people is your relative?

- Which of these has been your area code?

As an additional security precaution, KBA may have a time limit in order to complete. So, even if a fraudster were inclined to do the research and answer the KBA questions, it is unlikely that they would have sufficient time to do so.

What is Identity Verification (IDV)?

The second tool in the Fraud Prevention feature is called Identity Verification.

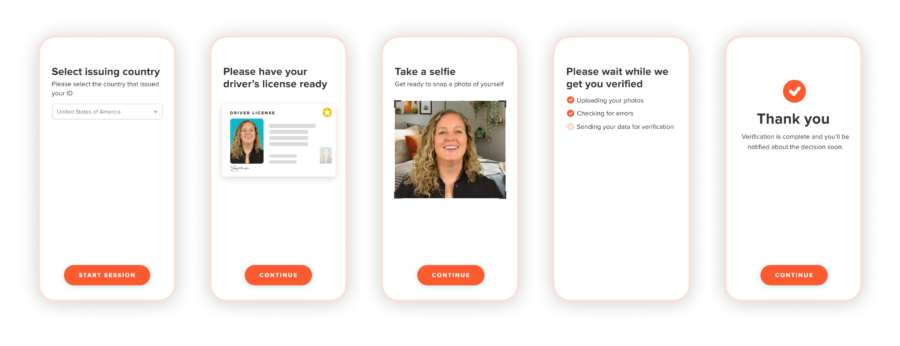

Identity Verification, or IDV, confirms that your applicant is using a legitimate government-issued photo ID. It then verifies that the applicant is the same person represented in their ID by matching their ID photo to a selfie taken in real time.

Applicants are prompted to submit a photo of their government-issued photo ID, followed by a live selfie. We help ensure an accurate match through various mechanisms. Machine learning technology guides users to take high quality photos, helping applicants adjust any issues such as poor lighting, glare, or a cropped image.

Then, we deploy several checks to verify that the ID is legitimate, and that the applicant is the person represented in the ID. These include network and device analytics, data extraction, manual and automated ID checks, biometric analysis, and liveness checks. It all takes just a few moments.

Identity Verification supports over 10,000 government-issued IDs from 190 countries, making IDV an ideal choice for mitigating fraud among international applicants.

How does Fraud Prevention work in Submittable?

KBA and IDV are each sophisticated fraud mitigation tools. But deploying them through Submittable couldn’t be easier.

Simply drag and drop the new Fraud Prevention form field into your form and enter your question, choosing either KBA or IDV. Decide whether you want to conceal responses from your review team to prevent bias, or apply an auto-label of scores or codes to filter applications later.

That’s it.

It’s easy to use for applicants, too:

- For KBA, your applicants will receive a personalized quiz with clear instructions and five minutes to complete.

- For IDV, applicants will be directed to scan a QR code with their smartphone or use their computer webcam to take a photo of their identity document and then a selfie.

In both cases, it’s a quick step for your legitimate applicants, while foiling the fraudsters in their tracks.

When you receive applications, according to your preferences, you’ll have access to applicant KBA scores and/or IDV pass/fail data. Applicants will not see or receive their results.

How will the new Fraud Prevention feature help me and my team?

KBA and IDV will go a long way toward avoiding identity fraud, focusing your team and helping you meet your goals. Specifically, Fraud Prevention will:

Reduce fraud

Knowledge Based Authentication and Identity Verification are two of the strongest anti-identity fraud tools out there. Why? Because they work. Applicants who pass the KBA quiz, or whose selfie matches their government-issued photo ID, can be reasonably assumed to be who they say they are—whereas those who fail merit additional scrutiny.

Inform your decisions

Fraud Prevention gives you information that helps you determine the risk of identity fraud among your applicants. It’s also customizable to your organizational needs. How you use the information in your review and decision-making process, such as whether to reveal or conceal it from reviewers, or what level of passage vs. failure is acceptable for you to move an applicant forward, depends on your program and is up to you.

Save time

No matter what you choose to do with the fraud prevention data, you’ll save time. For example, with KBA, you could streamline applications for those who pass, apply additional scrutiny to those who score a three or four out of five, and automatically deny those who fail with a two or lower score. In this case, you’re pursuing your objectives and moving quickly, subjecting only the riskier subset of applicants to an additional review phase.

Use the right tool for the right applicants

Submittable’s Fraud Prevention tools are flexible. You have full discretion over which tool you’d like to use (or both) and whether they are required. You can even support both U.S. and international applicants.

Get funds where they’re needed. Fast

The heartbreaking thing about fraud is that funds intended for people with legitimate, often urgent needs, are misappropriated to others. Mitigating fraud means more of your funds are reaching their intended recipients. Even better? These tools are so efficient that they won’t hinder your ability to run an agile emergency program.

Protect your reputation

Sadly, when victim to significant fraud, governments and other organizations face a PR nightmare. Why did this happen? Why wasn’t it prevented? Mitigating fraud risk is a long-term investment in protecting your brand and confidence in the integrity of your programs.

How can I add Fraud Prevention to my account?

Fraud Prevention is available for purchase now for enterprise Submittable customers. Contact your customer success manager to learn more about adding it to your account.

Also new from Submittable

Submittable is constantly innovating, and Fraud Prevention is only the latest in our suite of powerful new capabilities for our customers. We recently released:

- Submittable Data Sharing with Snowflake: You can now bring your Submittable data into your Snowflake warehouse, where you can enrich it and pull it into your business intelligence tools for deeper insights.

- DocuSign Integration: For the most convenient way to gather eSignatures for agreements and contracts, you can now integrate Submittable with your existing DocuSign account.

Learn more about Submittable

Submittable is a social impact platform that organizations in the public, private, and nonprofit sectors use to run equitable and agile grants and other programs. We partner with you to ensure your programs are successful—from launching quickly, to managing with ease, to reporting on impact. Request a personalized demo with an expert on our team today.