When a foundation or business decides to support a new cause, it can feel like the last step in a long process. Folks have had to advocate, find money in the budget, and convince leadership to make the investment. However, deciding on next steps can be tricky. Setting an intention to donate is great, but how do you ensure your contribution makes a difference?

You might not have all the answers right away. That’s okay. The grantmaking world is built on relationships. A strategic alliance with a nonprofit whose mission aligns with yours may be just what you need to move forward.

For grantmakers looking to extend their reach and strengthen their network, a partnership with a funding intermediary can be a useful tool. Though intermediaries are sometimes seen simply as go-betweens, with the right relationship in place, they can be much more than that. An intermediary can also add value—through expertise, relationships, or capacity—while serving as a bridge between funders and the causes they feel most passionate about supporting.

What is a funding intermediary?

A funding intermediary is an entity that serves to connect donors to the people and causes they want to fund. In the world of philanthropy, these intermediaries are most often organizations with a focused mission and a unique expertise.

For foundations and grantmakers considering funding intermediaries, building the right partnership takes more than just finding a nonprofit whose mission you believe in. You need to understand the benefits and limitations and work to establish a relationship that serves both organizations.

6 benefits of funding intermediaries

Enlisting a funding intermediary allows you to leverage their strengths as an organization to ensure you have a meaningful impact. This is particularly useful if you’re looking to support a new cause or a specific community. The right partnership can allow you to:

1. Connect directly with the community you want to serve

An intermediary might have the connections you don’t. Perhaps they speak the local language, have established trust with community members, and have taken time to develop an understanding of what folks truly need. This means they can create targeted programs and grants to address the most pressing issues.

2. Reduce administrative and legal costs

An established intermediary can provide the administrative and legal framework you need. They have already hired staff, applied for tax-exempt status, and put processes in place to serve grantees. By relying on their systems, you can minimize your overhead costs and allow more resources to go directly to those in need.

3. Move quickly

In times of crisis, when you’re trying to deliver funds to a community in dire need, the last thing you want is to be sorting out a grants management process and hiring new employees. That’s like trying to build a car when someone needs a ride. An intermediary has already done the hard work. They’ve built the car; you just have to add fuel.

Looking to streamline your grant management process?

Submittable simplifies your process and gives you robust tools for seamless collaboration.

4. Tap into a deep well of expertise

Effective philanthropy requires research, relationship-building, and financial management. It’s possible that your in-house staff has these skills and the time to dedicate to this work, but that may not be realistic. On the other hand, an intermediary has already invested in this development. Plus, their real-world experience adds an additional dimension to their knowledge base.

5. Build capacity

Especially for smaller organizations, finding an intermediary can allow for capacity building. You can team up with others who have a similar end goal to pool your resources and maximize your investment.

6. Integrate your goals into a broader mission

A funding intermediary can provide a strong vision. If an organization has a solid history in their field, they may be working on a longer-term horizon and may have a sense of how your goals fit into a broader landscape. For donors who know they want to give but aren’t sure how, a partnership can provide direction and ease, ensuring that their donations provide real benefits to those in need.

Understanding the options: 5 types of intermediaries

Grantmakers can reach out to intermediaries for a variety of reasons. Before doing so, it’s worth understanding a bit about the structure of potential partner organizations. Some will focus on specific causes, while others have a broader aim. Here we take a look at some of the possible options. Keep in mind, these designations are not exclusive; some organizations will fall into multiple categories.

No matter what community or cause you decide to support, the right partner should offer you stability, strategy, and expertise. When you’re searching for the right partner, look for these five traits.

Regranters

Regranters take grant money from government agencies or foundations and spread the funds out by providing grants to smaller, more local organizations. These small organizations will either provide direct help or allow the funds to be regranted even further. This regranting process allows large grants to have a wide impact and helps ensure that nonprofits don’t overextend their capacity to administer extremely large grants.

For example, the Arizona Commission on the Arts receives funds from the State of Arizona and the National Endowment for the Arts. They use this money to provide direct support to artists in the state through grants such as the AZ CARES Grant and the Research and Development Grant. By doing so, they allow artists to access grant money without having to apply for funding through the state and federal government, which can be a cumbersome process.

Local or indigenous philanthropies

Smaller, mission-driven local or indigenous philanthropies provide an on-the-ground presence. They have a strong connection to the folks they serve and can ensure that grants have a real impact. With focus in the philanthropy world shifting toward local empowerment, these organizations play an important role. They can help amplify the voices of those in need and ensure that the community has a say in how aid is distributed.

Edgar Villanueva, author of Decolonizing Wealth, explains the recent shift in how giving is structured, with large institutions ceding control to local, grassroots campaigns. “I think there was more willingness in 2020 to trust community-based organizations led by people of color to deploy capital in a way that foundations are often ill-equipped to do,” he says.

One example is Seventh Generation Fund, which responds to the needs of grassroots indigenous communities. They provide training and technical support to local affiliates such as the Buffalo Defense Project and the Ho’opae Pono Peace Project, and they’ve established themselves as a trusted advocate for indigenous causes across the nation.

Donor-advised funds (DAFs)

A donor-advised fund (DAF) is essentially a charitable investment account controlled by a 501 (c)(3). Any money that isn’t donated right away will be invested tax-free. This means that you can take an immediate tax break while stretching your impact over time.

DAFs allow you to rely on the expertise of the fund sponsor while you provide guidance about how to direct your investment. For example, the Tides Foundation has a fund dedicated to defending voting rights. They use this fund to administer grants and target local campaigns. By donating, you can have a concentrated impact without spending time researching and vetting organizations.

Though investing in a DAF can provide a benefit to a donor right away, the social impact is delayed. According to the National Philanthropic Trust’s 2020 DAF report, there is over $141 billion currently sitting in DAFs. For communities in need, consider the impact this money could have if it were distributed now.

Venture philanthropy funds

Venture philanthropy funds sit at the intersection of finance and philanthropy. They use the philosophy of venture capital investing to encourage development, often making investments in projects they see as having a social impact. With an established pipeline, they can generally get money to entrepreneurs quickly.

For instance, the Celo Community Fund supports projects that align with Celo Foundation’s mission of equity. They seek to build a financial system that creates conditions for prosperity for everyone. With a focus on education, technical research, environmental health, community engagement, and ecosystem outreach, they invest in innovative ideas that use the open-source Celo platform to grow their businesses.

“Friends of” funds

“Friends of” funds tend to funnel money and support to one specific nonprofit. Often the fund is a public charity meant to support a private foundation or government entity that cannot achieve tax-exempt status. This allows all donors to get tax deductions. “Friends of” funds are particularly useful for international giving, allowing U.S. donors to support foreign organizations while still getting a federal tax break.

One example, Friends of the Chappaqua Library, is a nonprofit organization that works closely with library staff and volunteers in Chappaqua, New York. They support programs and purchase special items that aren’t in the operating budget, allowing the library to offer more services and improve their facilities. In essence, they do the fundraising work the city and county employees often cannot do.

6 steps for choosing an intermediary

Similar to the strategies you might use to guide grantmaking or social impact programs, your approach for selecting an intermediary should be systematic. Follow these steps to find the right funding intermediary for your organization.

1. Determine an end goal

Before you get started, you want to decide what exactly you are trying to achieve. Consider—is there:

- a cause you want to support?

- a community you want to empower?

- a problem you want to solve?

Spend some time with your team to decide where you want to have an impact. If you’re not sure how to start, consider causes that align with the mission of your foundation or business. Discuss what exactly success would look like. Get as specific as possible.

If you think your organization or business can achieve your goals in a reasonable timeline without adding too many administrative costs, you might want to keep the project in house. But if you don’t feel you have the expertise or capacity to do so, an intermediary might be the answer.

2. Do your research

Once you have honed in on focus, it’s time to do the research. First, check to see if there are organizations already doing the work you hope to do.

If you can’t find anyone doing precisely the targeted work you care about, look for organizations that are adjacent to the cause. Perhaps through a partnership you can launch a new initiative.

Once you narrow your list of potential intermediaries, be sure to check out each organization’s credentials. You can view details about their financial and administrative processes through the nonprofit information service Guidestar. You can also reach out to former grantees or check in with trusted community members. As you review information, ask these questions:

- Are they trusted in the community they serve?

- Do they have a good track record of delivering support and following through?

- Are their overhead costs similar to other nonprofits operating in the same space?

3. Get in touch & get aligned

Once you’ve picked out a potential partner, reach out to them to see if they’d be open to teaming up. Find out about their existing programs and processes and see if your goals align. Remember that they may have a deeper knowledge in their field; it’s worth listening to their perspective even if it differs from yours.

If you decide to move forward together, it’s important that you get on the same page about how you will collaborate. Ensure that both organizations give their input to create a plan that is reasonable and achievable for everyone. Put it in writing. Clarify expectations around:

- Roles and responsibilities

- Oversight

- Timelines

- Costs

- Decision-making processes

- How to define and measure success

Working across two organizations means you might have two sets of priorities and two different understandings of workflow and communication. Do your best on the front end to bridge your distinct approaches.

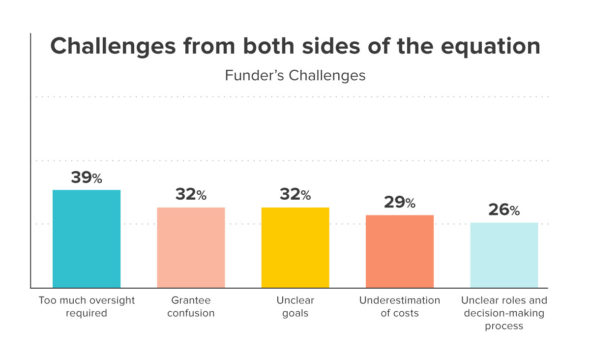

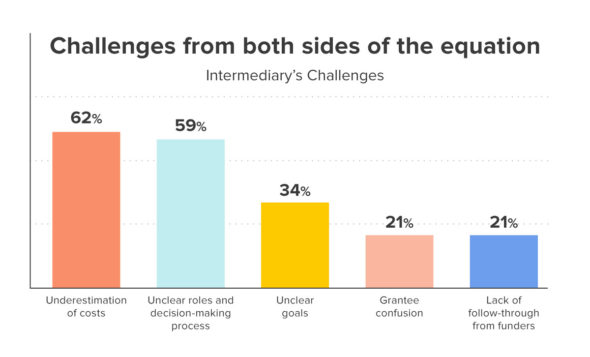

When the Fieldstone Alliance issued their Funder-Intermediary Relationships: Promise & Pitfalls Survey Report, they found that some of the biggest challenges included clarity around roles and responsibilities and inaccurate forecasting.

Beyond the obvious benefit of a smoother and more effective relationship, if behind the scenes you and your intermediary fully understand the scope of the relationship and the division of responsibilities, you will project that to grantees. You want to avoid confusion about who they should reach out to with questions and updates.

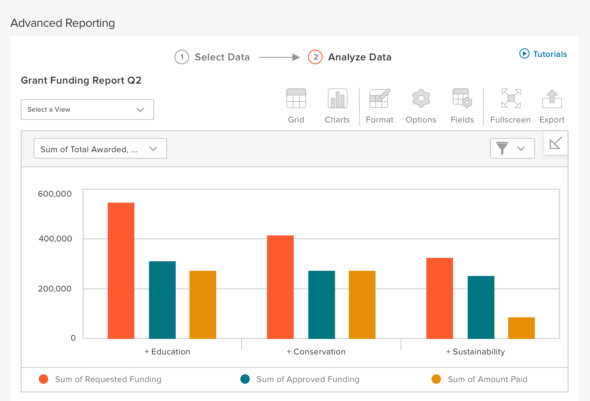

Using a grant management platform to collaborate is a great way to centralize the process. This allows multiple parties to be involved on the back end while creating a simple, straightforward experience for grantees.

4. Aim for equity

As you work with your intermediary to craft a plan, be sure to discuss how to make your programs equitable. Perhaps they already have strategies in place to address inequities in the grantmaking sphere. If not, collaborate to come up with possible solutions.

Incorporate strategies aimed at equity into your plan. Use these questions as a guide:

- How will you ensure that historically marginalized groups are included in your programs and initiatives?

- Are there opportunities to include the community in the grantmaking process through participatory grantmaking?

- Can you eliminate or reformat parts of the application process that may serve as an unnecessary barrier for some applicants?

- Is there a framework in place to address bias in the grant selection process?

Sometimes a solution is as simple as reimagining portions of your application. Rather than a written statement, can grantees opt to use audio or video clips and images to explain their work? This might make it more approachable for folks who don’t speak English as a first language.

5. Focus on deliverables

Although it’s okay to be involved in the process, be sure not to micromanage. You chose an intermediary for a reason. Trust them to do the work. The last thing you want is their time and energy focused on managing you rather than serving the community.

Setting goals can help you avoid the kind of micromanaging that can derail a relationship. Once you’ve agreed on a workflow, focus on impact over processes. Use your contract as a guide. If your intermediary is meeting the deadlines and achieving the goals you set together, you don’t need to insert yourself further into their process.

Want dynamic impact reports to tell your story?

Submittable makes it easy to gather quantitative and qualitative data to create a compelling impact report right in our platform.

6. Measure your impact

Working with an intermediary means there’s an added layer that can distance you from the grantee experience. This means it’s even more important to measure your impact. To help you understand the effect of your investment, you should make reporting part of your plan.

Your reporting tool should allow you to:

- Understand your overall impact on the community

- View quantitative data such as how many grantees received money and how they spent it

- View qualitative data such as examples of projects that were funded and how the grantees felt about the experience

- Hear directly about the process from the grantees’ perspective

Use the feedback you get to explore strategies to improve the process and experience for the future.

A good reporting tool allows you to step back and evaluate the intermediary relationship overall. Are you achieving what you set out to achieve? Are you having a measurable impact on the community you wanted to support? If so, you might look for ways to strengthen your partnership and explore more opportunities to team up. If not, you may decide to rethink your approach or shift strategies altogether.

Partnering with funding intermediaries for great results

When it comes to effective grantmaking, sometimes your best assets are the relationships you build with others dedicated to the same cause. Though establishing a funding intermediary can take some work on the front end, it can pay dividends in the long run by widening your reach and deepening your impact.

Submittable helps you make and maintain the connections you need. With tools to streamline communication across teams, measure impact, and ensure equity, it’s the ideal foundation to build a meaningful partnership. Find out more today.