Introducing Charity Check, a new feature powered by Candid (formerly Guidestar) that allows you to screen organizations for their tax exempt status at the eligibility phase as well as pull organization data directly into Submittable from Candid’s database.

Historically, for Submittable customers accepting applications from nonprofit organizations, the process to gather all of the data points needed has left a bit to be desired. Typically, we saw customers either ask applicants a slew of tedious questions, potentially creating barriers for resource-strapped nonprofits, or manually run the organization’s Employer Identification Number (EIN) number through Candid‘s database—which left the data outside of Submittable.

We’re pleased to say that after hearing your feedback, we’ve solved the problem. You can use the Charity Check feature in your eligibility form to pre-determine which types of nonprofits are eligible for your opportunity, or in your initial or additional form to pull data directly from Candid into Submittable.

It’s a win-win, and we can’t wait for you to try it. Here are the details.

What is Charity Check?

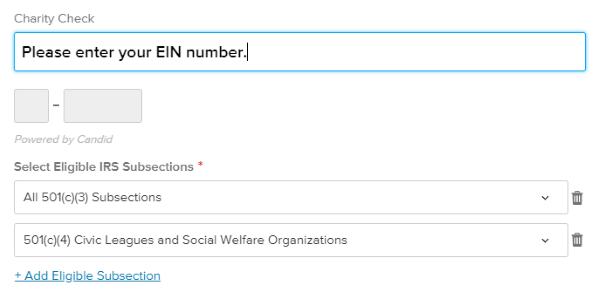

Charity Check is an easy-to-use form field in Submittable’s signature drag-and-drop form builder that prompts the applicant to enter their EIN.

- Add the Charity Check form field to your form. You can customize the exact wording or add any instructions.

- Collect EIN numbers from applicants. Applicants will enter their EIN number in the space provided when they fill out your form.

- Determine which types of organizations are eligible. When you use Charity Check in your eligibility form, you can determine precisely which type of tax exempt organizations are eligible or ineligible for your opportunity. Ineligible applicants will be unable to continue to your form. Learn more about eligibility forms.

- Collect organization data. When you use Charity Check on initial or additional forms, we’ll run the EIN through Candid’s database for you, and deliver the following data points:

- Organization name

- Organization address

- EIN

- Subsection description

- OFAC status

- Pub78 verified

- Most recent IRS BMF

- Most recent IRB

- Deductibility status

- Reason for non-private foundation status

- Most recent IRS Pub78

- Ruling date

How will Charity Check help me and my team?

Organizations using Charity Check may:

- Save time. Our automatic process means you’ll no longer need to look up EIN numbers on your own.

- Rely on trusted data. We’ve partnered with Candid (formerly Guidestar) to provide IRS data based on the organization’s EIN number in real time, so you can be confident in the data.

- Enjoy a cohesive data environment. The data will be pulled directly into your Submittable account, where you can view it within your submission and incorporate it in reporting.

- Get a more efficient process. Using Charity Check in the eligibility phase will allow you to identify and divert ineligible organizations based on your predeterminations regarding tax exempt statuses.

- Focus on your mission. The time saved by avoiding ineligible applications or dealing with finding data on your own can be repurposed on finding the right applicants and nurturing your relationship with them.

- Be respectful of applicants’ time. Rather than asking applicants for a ton of information, simply providing their EIN number gives you organization much of the information needed.

- Provide a positive applicant experience. Screening for eligibility with charity check saves would-be applicants the frustration of filling out an application for an opportunity for which they don’t qualify.

How can I add Charity Check to my account?

Charity Check is a premium feature that you can add to your accounts by contacting your account manger. Please note, Charity Check is only available on Submittable’s new form engine.

Also new at Submittable

Charity Check plays particularly well with our other new feature, eligibility forms. Learn more about how you can screen applicants for eligibility based on all kinds of criteria. Here are a couple other things you may have missed:

- Looking to speed up your review process, or limit the workload on your review team? Submission caps can help.

- No matter what kind of opportunity you’re creating on Submittable, it’s important to carefully consider the submitter experience. We recently shared these five key strategies that will help you do just that.

- Did you know that Submittable makes it incredible easy to collect fees and payments? From memberships to subscriptions, and from merchandise to professional services, our flexible payments tool can streamline your collection process (and maybe help bring in a little extra).

Learn more about Submittable

Just joining us? We’re glad you’re here. Our product experts are here to learn about your workflow and show you how Submittable can streamline the next opportunity you create, from your collection process all the way through collaborative review and reporting. Or, watch a demo to dive a little deeper right now.